I will stop posting Larry on Business with this post. I appreciate you following this blog.

I will stop posting Larry on Business with this post. I appreciate you following this blog.

I began this blog in July 2011 to help business owners grow their businesses. I’ve helped thousands of owners in the past two decades. I’ve worked with business owners in 30+ countries. I’ve helped them develop business plans, marketing plans, operational plans, and human resource plans. My client businesses improved revenues, sales, and profits. I am grateful for those who read this blog over the past 18 months. I also wish to announce that this will be my last post for Larry on Business.

Decide What to Do and What to Stop Doing

Business owners should focus their businesses on what they do extremely well. Authors proclaim “Stick to the knitting”. Jim Collins researched that great companies develop and adhere to hedgehog. To find that one thing your business does better than anyone else, and do it over and over and over.

He also encouraged businesses to stop doing things they may do well. They needed to avoid things that distract distract them from their core skills and business. Eliminating efforts on good things allows business owners to focus on better things.

For that reason, I will no longer post about business growth. Others enjoy better competence and thoughts.

Join Me to Learn How to Get Scholarship Money for College

I will replace Larry on Business with a new blog www.LarryonScholarships.blogspot.com. I will post the new blog on Tuesdays, Thursdays, and Saturdays.

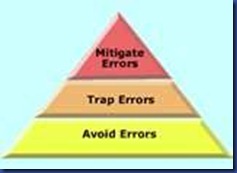

LarryonScholarships will focus on five steps to help youth, their parents, and other adults who want to get money to pay for college—money they don’t have to pay back (though we will also deal with loans a little bit):

- Set a goal for how much you want and believe they want to reward you

- Find sources of scholarships, grants, and other financial aid

- Prepare master applications so you can complete applications in less than 60 minutes

- Write reusable essays to submit with applications

- Obtain impressive letters of recommendation that verify your accomplishments

Tuesday, January 1, we begin our new blog www.LarryonScholarships.blogspot.com